What Can Be Financed Through Lease Purchase Financing?

| Equipment To Finance | Condition | Typical Terms |

|---|---|---|

| Buses | New | 1-7 years |

| Fire Apparatus | New | 1-15 years |

| Fire Apparatus | Used/Refinance/Refurbish | Contact Us |

| Ambulances | New/Remount | 1-7 years |

| SCBAs | New | 1-7 years |

| (PPE) Turnout Gear | New | 1-5 years |

| Police Cars | New | 1-5 years |

| Snow Plows/Dump Trucks | New | 1-7 years |

| Public Works Vehicle, light duty | New | 1-5 years |

| Public Works Vehicle, heavy duty | New | 1-10 years |

| Thermal Imaging Cameras | New | 1-5 years |

| Fire Chief Vehicles/Support Trucks | New | 1-7 years |

| Construction Type Vehicles or Equipment | New | 1-7 years |

| Misc. Equipment (Hoses, Radios, etc.) | New | 1-5 years |

| Law Enforcement Equipment | New | 1-5 years |

| Real Property (Fire Stations, Substations, Municipal Buildings) | New/Refinance | Contact Us |

The above chart shows examples of equipment we can finance for municipal and non-profit entities but is not a complete representation.

Financing to Meet Your Unique Needs

Every customer we work with provides unique and vital services to support their community. We understand the equipment essential to daily operations can change from year to year, and is different for each entity we serve. We provide fire truck financing, fire station lease financing, school bus financing, city equipment lease purchase financing, public works lease purchase financing, yellow iron lease purchase financing, and more. We work hard to meet each customer's unique needs and you can rest assured we will find a solution to work for you.

Delaying Equipment Purchases Costs You Money

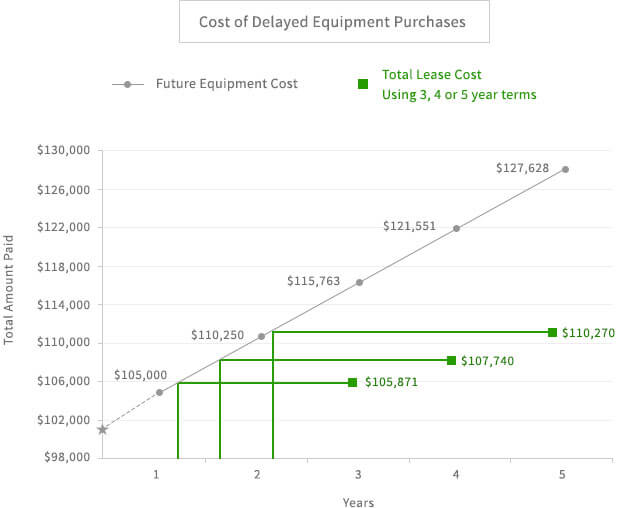

When long-term costs are factored in, a lease purchase may end up saving you money. At times, organizations feel they can only purchase new equipment if they have a substantial down payment or can pay cash for the purchase. By delaying the purchase, a customer is faced with regular manufacturer price increases, inflation, and the cost of maintaining aging and unsafe equipment, which may cost more in the long run.

Base equipment price used for example is $100,000. An average price increase of 5% per year has been used for “Future Equipment Cost” calculations. The prices and payments shown above are for estimation purposes only, and have been calculated in arrears. Please contact us for exact figures. Maintenance cost of aging equipment is not included in example.

We understand every entity has varying levels of revenue, savings and ability to service a lease payment. This graph illustrates if you can afford a:

- 3 year lease payment of approximately $35,290 per year, leasing would be more cost effective than delaying your purchase by just over 1 year.

- 4 year lease payment of approximately $26,935 per year, leasing would be more cost effective than delaying your purchase by 2 years.

- 5 year lease payment of approximately $22,054 per year, leasing would be more cost effective than delaying your purchase by less than 3 years.

While the purchase amount may vary from department to department, the illustration remains the same. Delaying a purchase will cost more money in the long run. Entering into a lease purchase plan today will provide fixed, manageable payments with cost savings over equipment purchases at a later time.